Global Magazine Publishing Outlook, 2014-2018

Magazines

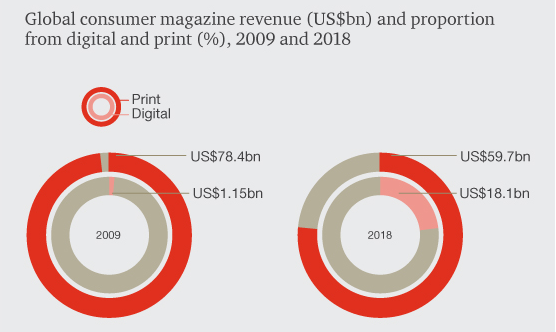

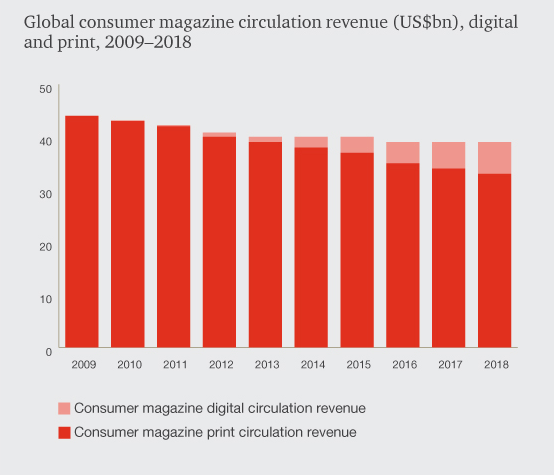

June 2014 - According to the latest five-year global magazine industry projections by PricewaterhouseCoopers (PwC), driven by digital, global total magazine revenue will resume growth in 2015. With this said, total consumer magazine circulation revenue will continue to decrease due to print declines.

Key magazine publishing insights from PwC's Global Entertainment and Media Outlook - Magazine Publishing Overview, 2014-2018:

1. Globally, total magazine revenue will resume growth in 2015.

-

In 2015, the magazine publishing industry will reverse years of decline to record a slight 0.2% year-on-year growth as overall digital gains outweigh falling print revenue.

-

In 2018, total magazine revenue will reach US$98.1bn, up from US$97.1bn in 2013.

Source: PwC, 2014

2. Digital consumer magazine circulation revenue will see the fastest growth, yet digital consumer magazine advertising revenue will be larger.

-

Global digital consumer magazine circulation revenue will rise at a 31.2% CAGR, reaching US$5.7bn in 2018.

-

Digital will move from 4% of total consumer magazine circulation revenue in 2013 to 14% in 2018, thanks to publishers having increased success in converting digital magazine readership from free to paid-for digital editions.

-

Global digital consumer magazine advertising revenue will be US$12.4bn in 2018, rising at a 17.6% CAGR. This compares to a decline of -3.9% CAGR for consumer magazine print advertising revenue.

-

Currently advertising focuses on magazine websites, but as digital circulations increase, digital magazines will become increasingly popular for advertisers.

3. All-you-can-read subscription services are yet to take off, but will be transformational. With this said, total consumer magazine circulation revenue will continue to decline.

- While they are still to gain traction, subscription services numbers are soon to reach critical mass, PwC projects. With growing magazine circulations will come rising circulation and advertising revenue.

- Yet, growth in digital circulation will not be enough to compensate for print declines and global consumer magazine circulation revenue will fall by a -0.7% CAGR to 2018. However, there are signs that the decline may level out in the long term, as the year-on-year fall in 2018 will be just -0.3%.

Source: PwC, 2014

4. Emerging economies will see the fastest growth in trade magazines.

China, India, Russia and South Africa will see the fastest growth in total trade magazine revenue as local businesses look to the global markets to inform their strategies, says PwC.

Turkey and Hungary will also see strong growth in trade magazine revenues with CAGRs of 5.3% and 3.7%, respectively, while Peru, Venezuela and Argentina will all see growth of at least 6.8% CAGR, albeit from a low base.

5. The U.S. magazine publishing industry will remain essentially flat.

U.S. Consumer Magazines

-

The U.S. consumer magazine market is estimated to be valued at $24.6 billion as of 2013, and will remain essentially flat through 2018, when its value is projected to be $24.7 billion.

-

Ad revenue is expected to increase at a 0.5% compound annual rate from 2013 through 2018, compared to a -0.9% CAGR for circulation revenue. Advertising accounted for about two-thirds of the market’s value last year (the other third is circulation revenue).

-

Print ad revenues are expected to fall (-6.9% CAGR). PwC projects digital ad revenues will offset those losses, as they grow at an annual rate of 19.2% to reach almost $7.6 billion in 2018. Print’s forecast is $9.4 billion in 2018.

U.S. Trade Magazines

-

The U.S. trade magazine market is estimated to be valued at $5.9 billion. It is projected to slowly grow, at a CAGR of 1.2%, to $6.3 billion in 2018.

-

Advertising accounted for three-quarters of the market’s value last year, up from 70% in 2009. Ad revenue is expected to increase at a CAGR of 0.9% from 2013 through 2018, compared to a 2% CAGR for circulation revenue, which will be driven by a huge 45.4% CAGR for digital circulation (though starting from an extremely small base).

-

Print ad revenues are projected to decrease (-4.4% CAGR), although digital ad revenues will again offset those losses, as they grow at an annual rate of 12.8% to reach almost $2 billion in 2018, closing in on print’s total of $2.7 billion.

About: Now in its 15th year, PwC’s annual Global entertainment and media outlook (Outlook) provides a single comparable source of five-year forecast and five-year historic consumer and advertiser spending data and commentary for 13 entertainment and media segments, across 54 countries.

Source: PwC, Global Entertainment and Media Outlook - Magazine Publishing Overview, 2014-2018. Accessed June 13, 2014.